Securing the Future: The Importance of a Medicaid Planning Attorney

Posted: April 30, 2024Navigating the complexities of Medicaid and long-term care planning requires foresight, knowledge, and a strategic approach. This is where a Medicaid planning attorney comes in. In regions like Miami, Pinecrest,...

Continue ReadingSafeguarding Legacies: The Critical Role of a Wills Attorney

Posted: April 16, 2024The creation of a will is a fundamental aspect of estate planning, ensuring that your assets are distributed according to your wishes and providing a clear roadmap for your loved...

Continue ReadingPreserving Control: The Comprehensive Guide to Living Trusts

Posted: April 2, 2024Navigating through the legal intricacies of asset management and estate planning is crucial for residents in the vibrant communities of Miami, Pinecrest, South Miami, Coral Gables, Coconut Grove, and the...

Continue ReadingPreparing for Tomorrow: How an Estate Planning Attorney Can Help

Posted: March 19, 2024Navigating the intricacies of estate planning is a task that calls for meticulous attention to detail and a comprehensive understanding of the future implications of today’s decisions. In communities across...

Continue ReadingNavigating the Probate Process: Insights from a Probate Lawyer

Posted: March 5, 2024The journey through probate can seem like a complex and daunting path, especially during a time of grief and loss. Located in the heart of communities such as Miami, Pinecrest,...

Continue ReadingWhy Aren’t Banks Protecting Elders

Posted: February 21, 2024

My husband has dementia which is why I did our taxes! Was it enjoyable, no but now that it’s over I’m thrilled that I know the process of compiling a...

Continue ReadingManaging the Legacy: Best Practices for Trust Administration

Posted: February 20, 2024In the vibrant heart of Florida’s communities—from Miami to Pinecrest, South Miami, Coral Gables, Coconut Grove, and beyond—families and individuals grapple with the complex process of managing legacies. Parent Your...

Continue ReadingStrategies for Coping with Loss and Ensuring Planning Reflects Your Current Wishes

Posted: February 15, 2024

Has your spouse or another loved one recently passed away? We know that this time around Valentine’s Day is a particularly poignant time where your feelings of loneliness and grief...

Continue ReadingFoundation of Security: Understanding the Role of a Trust Attorney

Posted: February 6, 2024In the dynamic and culturally rich regions of Miami, Pinecrest, South Miami, Coral Gables, and Coconut Grove, securing financial stability and legacy for future generations is a top priority for...

Continue ReadingFighting for the Vulnerable: The Need for an Elder Abuse Attorney

Posted: January 24, 2024In the picturesque communities of Miami, Pinecrest, South Miami, Coral Gables, Coconut Grove, and the surrounding areas in Florida, the silent yet grave issue of elder abuse persists. Parent Your...

Continue ReadingWill You Need to Pay Your Parent’s Florida Nursing Home Bill in the New Year?

Posted: January 22, 2024

Do you currently have a parent in a Florida nursing home? Were you aware that there is a question about whether children will need to pay an aging Florida parent’s...

Continue ReadingContinuing the Care: Why a Durable Power of Attorney is Essential

Posted: January 10, 2024Navigating through life’s uncertainties requires preparation and foresight, particularly when it pertains to legal and healthcare decisions. In the diverse and dynamic communities of Miami, Pinecrest, South Miami, Coral Gables,...

Continue ReadingWith a New Year Ensure Long-Term Care Planning is at the Top of Your Priorities

Posted: January 8, 2024

Being with your parents in the New Year, have you moved long-term care planning for them to the top of your priorities for the New Year? You are aware that...

Continue ReadingChampioning Rights: The Power of Elder Law Advocacy

Posted: December 27, 2023In the diverse and vibrant communities of Miami, Pinecrest, South Miami, Coral Gables, Coconut Grove, and the surrounding Florida areas, elder law advocacy stands out as a crucial service for...

Continue ReadingNavigating Declines in Health with Aging Parents Over the Holidays

Posted: December 25, 2023

Do your aging parents live in the Sunshine State of Florida? Are you visiting them during the holidays? Do you look forward each holiday season to the wonderful time spent...

Continue ReadingAfter the Farewell: Navigating the Complexities of Estate Administration

Posted: December 13, 2023In the tapestry of life, the certainty of change is woven with precision and care. For the families and individuals in Miami, Pinecrest, South Miami, Coral Gables, Coconut Grove, and...

Continue ReadingFlorida Medicaid Considerations You Need to Know When You Make Holiday Gifts

Posted: December 11, 2023

As you await the holidays and you know you will be seeing friends and especially family, are you thinking about gift giving? Do you want to give your adult children...

Continue ReadingUnderstanding Florida Medicaid and Long-Term Care for Today’s Seniors

Posted: November 21, 2023

As a senior, are you wanting to have a better understanding of Florida Medicaid and long-term care? As we age, understanding long-term care is extremely important. Long-term care goes beyond...

Continue ReadingKey Indicators Your Loved One with Alzheimer’s May Need Additional Support Outside the Home

Posted: November 7, 2023

Did you know that there is probably no adversary more formidable than Alzheimer’s Disease? It is a disease characterized by memory loss, cognitive decline, and various behavioral changes. Then, as...

Continue ReadingDo Spouses Need Powers of Attorney to Care for Each Other?

Posted: October 16, 2023

Are you married? Do you and your spouse have a Florida power of attorney? Are you aware that a Florida power of attorney (POA) is a legal instrument that grants...

Continue ReadingHelp Your Parents Get the Information They Need During Medicare Open Enrollment

Posted: October 9, 2023

Do you have aging parents on Medicare? Were you aware that Medicare’s Annual Open Enrollment Period begins in October? You need to know that during this enrollment period every year,...

Continue ReadingAre Your Aging Parents at Risk of Falling Right Now?

Posted: September 18, 2023

Do you currently have aging parents living in Florida? Are they still living in their own home where they raised their children? As you watch them age, are you concerned...

Continue ReadingAre Your Aging Parents Protected From Florida Guardianship?

Posted: September 11, 2023

Have you ever wondered what would happen to your aging parents if they were suddenly incapacitated due to an accident, injury or disease? As they get older, what would happen...

Continue ReadingEssential Summer Safety Tips for Aging Parents as Temperatures Rise

Posted: August 17, 2023Do you and your family enjoy the arrival of summer, with longer days, cherished moments with senior loved ones, tasty cookouts, and refreshing swims at the pool or beach? Summer...

Continue ReadingKey Reasons Why Your Aging Parents Should Not Put Off Getting a Medical Alert Systems

Posted: August 7, 2023

Did you know medical alert systems play a crucial role in providing emergency assistance and saving lives, especially for our aging parents who may face increased risks of health-related emergencies,...

Continue ReadingExploring the Relationship between Wills and the Florida Probate Process

Posted: July 17, 2023

With less than half of all Americans, according to research, having an estate plan in place today, have you taken the time to create one? We are very aware that...

Continue ReadingWhy Updating Your Estate Plan If You Are Relocating to a New State is Crucial

Posted: July 10, 2023

As you age, are you thinking you may need assistance in the future? Do you currently have a Florida estate planning attorney? Your attorney can assist you in making sure...

Continue ReadingEstate Planning Steps to Take When an Aging Parent Has Cancer

Posted: June 21, 2023

Have you recently been told by your aging parent that he or she has cancer? When you learned this devastating news, did questions rush through your head? Questions like: How...

Continue ReadingKey Reasons Why You Need a Florida Elder Law Attorney Nearby

Posted: June 13, 2023

As you age, are you thinking you may need assistance in the future? Do you currently have a Florida estate planning attorney? Your attorney can assist you in making sure...

Continue ReadingRecognizing the Power of the Boomer Generation and the Perks of Aging

Posted: December 25, 2022

As Boomers age, we must live up to our reputation as an explosive generation. Part of the “unseen elder” syndrome is our fault. We allow others to treat us as though we’re...

Continue ReadingHospice and Medicare: Senior Abuse?

Posted: December 15, 2022

My client’s 94-year-old mother was killed while in hospice. How? She fell out of bed, broke her femur, and died within days. She fell out of bed because the hospice...

Continue ReadingElders Can’t Survive Storms Without Help – We Are Obligated as a Culture to Create an Infrastructure to Help

Posted: November 25, 2022

Kaiser Health News (KHN) and AARP are great at espousing policy but ask them for “boots on the ground” assistance, and they refer you to a government agency. The last...

Continue ReadingHow Old is Too Old to Be the President of the United States?

Posted: November 15, 2022

What’s in a number? Forty-eight-year-old, Bret Stephens, a New York Times opinion columnist, thinks the number 86 is too old to be the President of the United States. This is the...

Continue ReadingThe Constant Battle to Protect Our Elders

Posted: October 25, 2022

As I write this, I’m on hold with the Alliance for Aging. This private, non-profit agency assists Elders in qualifying for Medicaid and other benefits. This was my third attempt...

Continue ReadingDementia is Not a Given

Posted: October 15, 2022

I have clients of all ages – some children and some parents. One client, an 87-year-old lady with dementia, only has me in her world. Her daughter predeceased her. Could...

Continue ReadingWhy Aren’t Banks Protecting Our Elders?

Posted: September 25, 2022

My husband has dementia which is why I learned to do our taxes! Was it enjoyable? No, but now that it’s over, I’m thrilled that I understand the process of...

Continue ReadingWhat You Should Know about Durable Powers of Attorney and Health Surrogacies

Posted: September 15, 2022

There are two documents everyone needs in their estate plan: The Durable Power of Attorney (DPOA) and a Health Surrogacy or Advanced Health Directive. Both documents are used when for...

Continue ReadingNavigating the Airport Wheelchair System

Posted: August 25, 2022

Wheelchair provider companies at most large airports have no competition, so they don’t have to try … and it shows. When Dad first needed a wheelchair, I used to drop...

Continue ReadingThe Best Way Out is Through

Posted: August 15, 2022

I am sometimes sad; upset with the hand I was dealt. I feel as though I can’t catch a break. It seems the whole world is against me, and I...

Continue ReadingWisdom, experience and knowledge are how Sully landed plane in water

Posted: November 8, 2021

When I was thirty, forty and fifty I had parties celebrating my age! Then fifty-five arrived… whoops, next I’d be sixty! For the following five years I lied about my age...

Continue ReadingFinances, Family and Death

Posted: November 5, 2021

Money conversations among family members can be a monster rearing its ugly head. Although Durable Powers of Attorney (DPOA) are in place which allow for shared responsibility and shared communication,...

Continue ReadingAdvice for Elder Law and Life Two Documents That Solve Multiple Problems: DPOA and Living Will

Posted: September 2, 2021

There are two documents everyone needs once they are adults. The Durable Power of Attorney (DPOA) and an Advanced Healthcare Directive/Living Will. These documents are used when you’re in a...

Continue ReadingThat’s the dream

Posted: August 13, 2021

At 73, Hips swinging in her bodycon Armani dress, she walks across the tile floor, heels clicking. Ahhh, it’s good to be tall! She meets people’s eyes, smiles, demurely looks...

Continue ReadingCOVID Hypocrisy

Posted: May 4, 2021

Slowly we’re getting vaccinated, tested and the ‘positivity’ rate is coming down. We still have all the CDC guidelines in place and the media is warning us of another possible...

Continue ReadingDO YOU REALLY WANT TO BE A CAREGIVER

Posted: May 4, 2021

Don’t you love the advice given by periodicals, talk shows and the internet on how to age or be a caregiver? Everyone has advice but no real solutions. Until you...

Continue ReadingEstate plan

Posted: May 4, 2021

I was visiting my client at her Assisted Living Center on a fabulous campus that includes an Independent Living Tower and a Nursing Home. As I walked up to have...

Continue ReadingGood health, education and an economic environment

Posted: March 5, 2021

I listened to Hillary Clinton (#HillaryClinton) and Nancy Pelosi (#NancyPelosi) chat and praise each other on Secretary Clinton’s podcast, You and Me Both which aired January 18, 2021, (#youandmeboth). Both...

Continue Reading“Microaggressions” and “implicit bias”

Posted: February 23, 2021

Microaggressions” and “implicit bias” are not new words but have come into mainstream verbiage because of the #metoo and #blacklivesmatter movement. The broad definition of both is remarks or actions...

Continue ReadingThe vaccine is here!

Posted: February 3, 2021

The vaccine is here! (Fireworks! Applause! Confetti!) But is it? I applaud Florida for vaccinating the over 65 crowd first but not the manner in which it’s done. How many...

Continue ReadingWow, 2020 is over!

Posted: February 3, 2021

Wow, 2020 is over. Phew! Yet, think about it, 12 years ago we were all ringing our hands at the end of 2008 as the Great Recession a/k/a the Financial...

Continue ReadingGrace and Virtue

Posted: November 3, 2020

We value virtue but do not discuss it. The honest bookkeeper, the faithful wife, the earnest scholar get little of our attention compared to the embezzler, the tramp, the cheat....

Continue ReadingTechnology for Caregivers

Posted: September 2, 2020

The Best Tools and Technology for Long-Distance Caregivers Many caregivers live too far away from their loved ones to provide hands-on care. However, that doesn’t mean you can’t take care...

Continue ReadingTHAT AGE OLD STORY OF LOVE & GLORY

Posted: July 8, 2020

I think of some of the “senior” love stories I’ve heard and seen. One favorite is my maternal grandmother and grandfather — Mimi and Dad. Dad died at the relatively...

Continue ReadingResiliency

Posted: July 8, 2020

What more can happen to us?!? Pandemic, police killings, protests, riots . . . take a breath! Why has this happened. All this chaos! ARGH! One answer is hubris. Most...

Continue ReadingGood news and gratitude

Posted: July 8, 2020

Senior Sex Toys was one of the many ideas I had for this week’s column. Aren’t we all tired of Covid 19 and its grizzly counts? No one is counting...

Continue ReadingCelebrate

Posted: April 7, 2020

Did you know that Dr. Fauci, Director of the National Institute of Allergy and Infectious Disease, was the Captain of his High School Basketball team and he’s “about” 5’7” tall?...

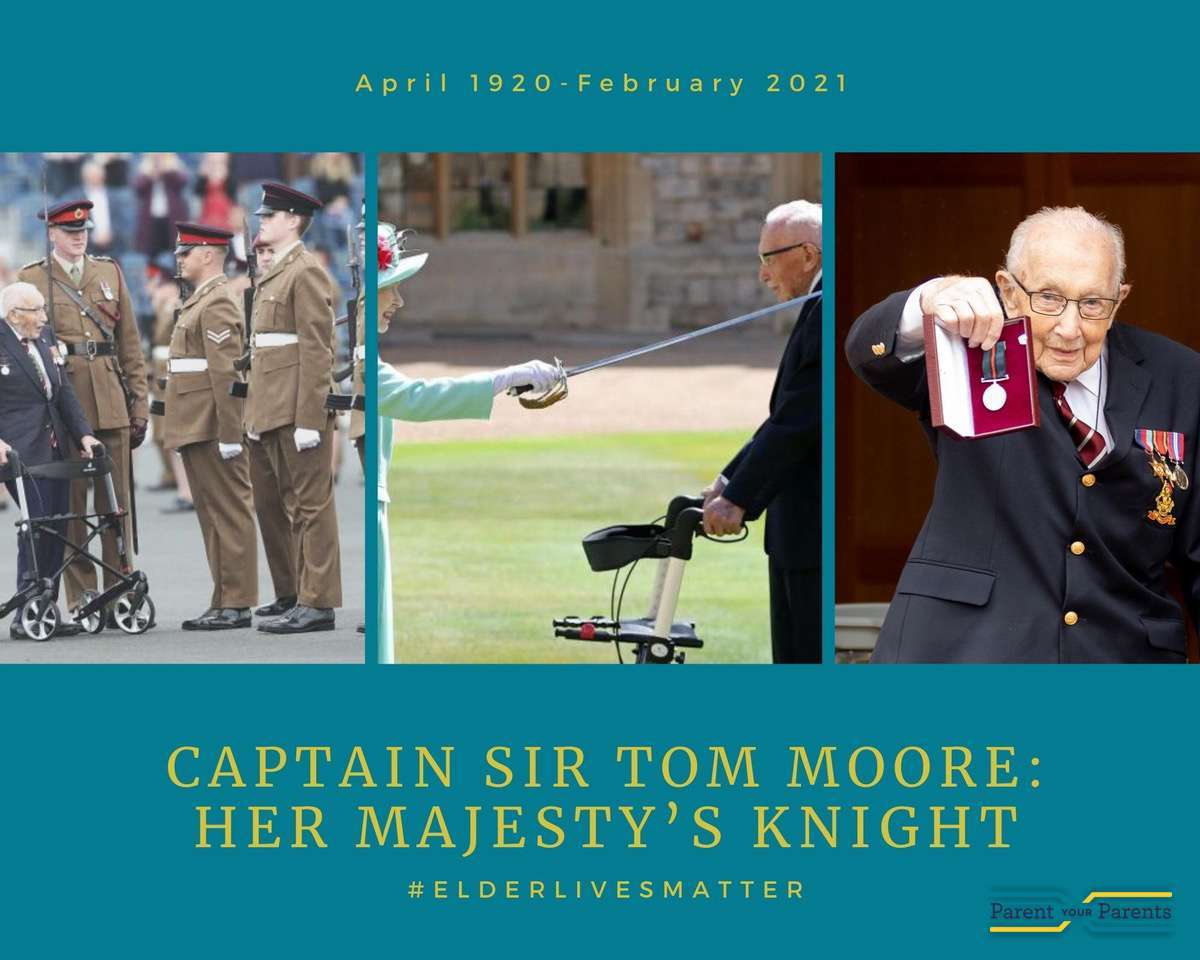

Continue ReadingFind Good in the Bad

Posted: March 25, 2020

Thank goodness seniors have wisdom, creativity and the confidence to draw upon them in a time of crisis. The bad news is everywhere – either you’re at risk for becoming...

Continue ReadingReflections on being 90, 95 or 100

Posted: February 28, 2020

In Great Britain, when one of her subjects turns 100, Queen Elizabeth sends them a birthday card. Next year her husband will join those ranks. This year there are 13,000...

Continue ReadingGetting involved

Posted: February 12, 2020

Studies abound about seniors who are lonely or feel isolated. It turns out it’s not as bad as we thought. Some statistics: loneliness surveys from AARP and the University of...

Continue Reading‘Death at home’

Posted: February 6, 2020

‘Death at home’ has become a societal priority and the scene painted is idyllic – the patient is ‘at home’, in bed, surrounded by loved ones in a familiar environment. ...

Continue ReadingAGEISM – ALIVE AND WELL

Posted: February 4, 2020

As the population looks to elect a President over the age of 75, the exact opposite is happening in the workplace. In 2018 the Equal Opportunity Commission, the nation’s workforce...

Continue ReadingSpousal Refusal

Posted: January 28, 2020

Spousal refusal is a legally valid Medicaid planning option in just two states: New York and Florida. By way of background, certain income and assets are exempt from Medicaid if...

Continue ReadingYou can’t teach an old dog new tricks

Posted: January 28, 2020

“You can’t teach an old dog new tricks” . . . “old habits die hard” . . . “you’ve made your bed, now you have to lie in it” and,...

Continue ReadingBeware of Reverse Mortgages

Posted: January 27, 2020

My parents had a Reverse Mortgage. When they moved out in 2014 the house was returned to the Department of Housing and Urban Development through a process called a Deed...

Continue ReadingDEMENTIA – BE RESPECTFUL

Posted: January 27, 2020

Alzheimer’s, a form of dementia, is a bit like “mental illness” – we lower our voice when we mention that someone in our family or “circle” has been diagnosed. Further,...

Continue ReadingWhy Aren’t We Worried About Our Presidents Losing Cognitive Function?

Posted: January 22, 2020

Why Aren’t We Worried About Our Presidents Losing Cognitive Function? In 2020 we will elect a new President. In 2017, Donald Trump, at the age of 70, was the oldest...

Continue ReadingPARTY HEARTY WITH EVERYONE!

Posted: January 22, 2020

????IT’S THE MOST WONDERFUL TIME OF THE YEAR???? sings Andy Williams in his iconic holiday song. Yet for many seniors it’s the worst time. They no longer have family or...

Continue ReadingSEX and the single senior

Posted: January 22, 2020

Sex and the single senior or alive and well. Simply because we look old doesn’t mean that fantasies of throbbing members and wet flowers are gone. In fact, STDs (Sexually...

Continue ReadingHospice and Medicare Can be a Deadly Cocktail

Posted: October 2, 2019

My client’s 94 year old Mother was killed while in Hospice. How? She fell out of bed, broke her femur and died within days. She fell out of bed because...

Continue ReadingPolicing hospice

Posted: July 17, 2019

The Son wakes up at all hours of the night. He hears his Mother groaning, her cries and sees her contorted face when she tries to hide the pain. He...

Continue ReadingSix Elder Abuse Myths

Posted: July 17, 2019

There are many misconceptions about how, why and how often abuse occurs. Myth No. 1: Most elder abuse occurs in nursing homes Fact: Most elder abuse occurs by family, trusted friends,...

Continue Reading87% of US hospices surveyed had deficiencies, inspector general says

Posted: July 15, 2019

A pair of startling new reports from the U.S. Department of Health and Human ServicesOffice of Inspector General paints a troubling picture of America’s hospice system — with serious deficiencies...

Continue ReadingHIPPA SHMIPPA

Posted: June 26, 2019

HIPAA, the Health Insurance Portability and Accountability Act of 1996 is legislation that provides data privacy and security provisions for safeguarding medical information. That’s not all it does . ....

Continue ReadingDo you think you’re ready ? Well, you’re not.

Posted: June 5, 2019

Thank you readers for all your wonderful, validating comments about my very personal article in discussing Mom. I also want to thank Raquel Garcia, the Associate Editor, for encouraging me...

Continue ReadingMom goes to nursing home

Posted: June 5, 2019

The hardest thing I ever did was put my 87 year old Mother’s belongings in a 4 X 4 box and admit her to a nursing home. We had run...

Continue ReadingHospice Care & Palliative Care – When to use Them

Posted: April 10, 2019

Hospice a word that is synonymous with “end of life” care. Palliative – a little more confusing and often confused with ‘end of life’. The two are very different therapies...

Continue ReadingHow to Avoid Falls at Home

Posted: April 8, 2019A practical guide for seniors and their family members. We would like to provide you with some practical information on how to prevent the fall of older people, who may...

Continue ReadingWhat did Luke Perry teach us.

Posted: April 8, 2019

LUKE PERRY (90210) SHOWED US HOW TO DIE. Luke Perry suffered a major stroke at 52. Like many in the movie industry, he had a blended family . . ....

Continue ReadingWe’ve Grown Up But Not Old

Posted: April 3, 2019

“The trick is growing up without growing old.” Casey Stengal Most of my 65-and-over friends work – one has a retail store, another (at 80) still does Public Relations for...

Continue ReadingVideo: Statistics Don’t Lie. Family are the Biggest Abusers

Posted: March 22, 2019

Who are the worst exploiters of seniors? Family, Friends, and Trusted Professionals! Watch the video to find out more.

Continue ReadingTECHNOLOGY: HELP DON’T HINDER SENIORS

Posted: March 21, 2019This past week I was with a client for whom I do legal work. I adore her, a retired college professor with a great sense of humor! She has mobility issues...

Continue ReadingPREPLANNING TOOLS

Posted: March 15, 2019

As everyone is aware, the mantra of Parent Your Parents is two-fold – DO NOT EXPLOIT OUR SENIORS and PREPLAN! Today I want to give you some preplanning tools to...

Continue ReadingReal Senior Exploitation: Buzz Aldrin’s Story

Posted: March 6, 2019

WHO IS THE WORST EXPLOITERS OF SENIORS – FAMILY! I WORK CONSTANTLY AT TRYING TO GET MONEY BACK FROM SOLAR POWER COMPANIES WHO SELL SENIORS UNWEILDY 20 YEAR CONTRACTS, BUT...

Continue ReadingThe warning signs of financial abuse

Posted: March 6, 2019

Following are some signs that financial elder abuse may be occurring: Senior is not allowed to spend money the way the senior wants Senior’s bills are not paid on time...

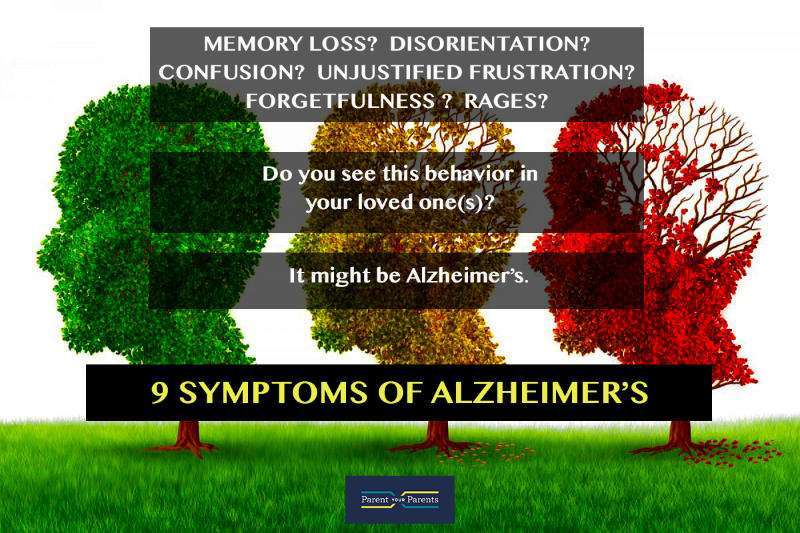

Continue Reading9 Symptoms of Alzheimer’s

Posted: February 1, 2019

Do you know these basic signs of Alzheimer’s? An Alzheimer’s diagnosis is upsetting but there are positive steps everyone can take to make this as easy as possible for those affected.

Continue Reading“(Super) Heroes Are Made Not Born!

Posted: January 15, 2019OMG!! Stan Lee the MAKER of super heroes died! As most of us know, he was the creative genius behind most of Marvel’s super heroes, BUT his wife Joanie was...

Continue ReadingSenior Exploitation and Abuse

Posted: January 7, 2019

THE WORST CRIME OF ALL – SENIOR EXPLOITATION We hear horror stories of nurses and aides murdering seniors by giving them to much medication or basic neglect (like Holly wood...

Continue ReadingStay Relevant, Smart & Sexy

Posted: December 30, 2018The past year the news has often included the failure of the Broward County Sheriff’s department to prevent the bloodletting on Valentine’s Day at Marjory Stoneman Douglas High School. And it...

Continue ReadingResources for Caregiving from Afar

Posted: December 22, 2018Our resource partner, Claire Wentz http://caringfromafar.com/, wrote this informative article we thought you would enjoy! Sometimes, living close to a senior parent who needs support isn’t an option. Uprooting a family...

Continue ReadingThe Pleasures of Old Age

Posted: August 30, 2018

“Old age has its pleasures, which, though different, are not less than the pleasures of youth.” W. Somerset Maugham. With maturity comes an ‘ease of being.’ It’s true,...

Continue ReadingWALKING ON THE MOON DOES NOT KEEP YOU FROM AGING

Posted: August 15, 2018Buzz Aldrin, the second man to walk on the moon, is 88 years old and has met his fourth wife. The bad news, the kids don’t like her. Here’s...

Continue ReadingAGING ALONE? PREPLAN TODAY!

Posted: August 6, 2018Teddy Roosevelt once said, “Old age is like everything else. To make a success of it you’ve got to start young.” That is especially true if you plan to...

Continue ReadingRethinking the “I’m Old” Myth

Posted: July 21, 2018

Now that I’m a senior advocate and activist, I find that many things that used to be funny are now insulting. Recently, Julie Andrews did a performance to benefit AARP...

Continue ReadingGROW OLD OR PURSUE YOUR DREAM?

Posted: July 10, 2018Gabriel García Márquez states it beautifully, “It is not true that people stop pursuing their dreams because they grow old, they grow old because they stop pursuing their dreams.” ...

Continue ReadingMedicare Supplement Insurance . . . It Can Be Tricky

Posted: June 15, 2018George, an 85 year old, was surprised when he received a $4000 bill for his pacemaker replacement procedure, after he was told that it would cost him $250. He’d...

Continue ReadingTREATMENT OPTIONS

Posted: May 30, 2018Once a family member becomes ill, we seem to go into a reactive mode instead of proactive mode. Much of this stems from our avoidance . . . we...

Continue ReadingVIVE LA VIDA BUENA (LIVE THE GOOD LIFE)

Posted: May 5, 2018From March 6 to April 8 of this year, I experienced five deaths of people I consider part of my life. Two were wonderful with whom who I had the...

Continue ReadingFLORIDA ADDS MORE MONEY FOR SENIOR CARE

Posted: March 23, 2018As we all now know, after Hurricane Irma fourteen elderly souls died because the nursing home in which they resided did not have a electricity after the storm. As a...

Continue ReadingEmergency Preparedness for Seniors

Posted: March 2, 2018The article below was published by Nursing Home Law News. It was written by Jonathoan Rosenfeld who is the publisher and an attorney. The best part of this article is...

Continue ReadingElder Rage: How to Survive Caring for Aging Parents

Posted: February 8, 2018We at Parent Your Parents think this is a terrific “true experience” article authored by Jacqueline Marcell. Jacqueline is also the Author of Elder Rage @www.ElderRage.com. Check it out! Jacqueline Marcell,...

Continue Reading